Financial Development, Globalization, and Structural Transformation in Developing Countries

Recommended citation: Avoumatsodo, Komla (2023). “Financial Development, Globalization, and Structural Transformation in Developing Countries”, Working Paper.

Download the paper from this link

I. Motivation

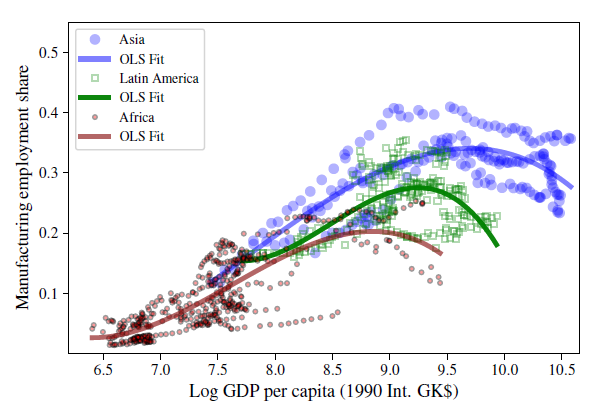

• Deindustrialization is occurring along different peaks of the hump-shaped path of manufacturing employment share across countries, and these peaks occur at varying income levels

Figure I below illustrates the evolution of employment share in manufacturing across different levels of development and by region. It distinguishes between Asia (represented in blue), Latin America (in green), and Africa (in dark red). We can see that the peak manufacturing share of African countries is lower than that of Latin American countries, which, in turn, is lower than the peak share in Asian countries. Furthermore, these peaks occur at sequentially lower levels of development, underscoring the manifestations of premature deindustrialization across regions.

FIGURE I: Deindustrialization across regions, 1950-2010

• What does this paper do?

Numerous studies, including those by Sposi et al. (2021) and Huneeus & Rogerson (2023), propose that sector-biased productivity growth accounts for the patterns of deindustrialization observed across various countries. However, the question of why productivity growth is biased towards particular sectors remains unanswered. Initially, I demonstrate that financial development may influence the distribution of productivity growth across sectors and countries. Following this, I develop a three-sector endogenous growth model to investigate the effects of financial development on a country's structural transformation. In addition, I examine how integration with deindustrialized countries, facilitated through the process of technology adoption, can affect the share of the manufacturing sector.

II. Model predictions

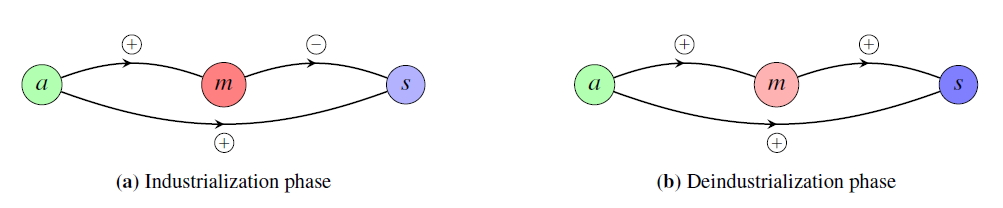

• Finance and Structural Transformation

Figure II below exemplifies the impact of financial development on country' structural transformaton. During the industrialization phase, where the growth rate in agriculture ($g_a$) is greater than that in services ($g_s$), which in turn is greater than that in manufacturing ($g_m$), resources are primarily reallocated from the agricultural ($a$) and service ($s$) sectors to the manufacturing sector ($m$). This reallocation is further amplified by the level of financial development, favoring higher growth in the agricultural and service sectors. Conversely, during the deindustrialization phase, where the growth rates satisfy $g_a>g_m>g_s$, resource reallocation is directed more towards the service sector. This shift is again amplified by the level of financial development.

FIGURE II: Impact of financial development on ressource allocation across sectors.

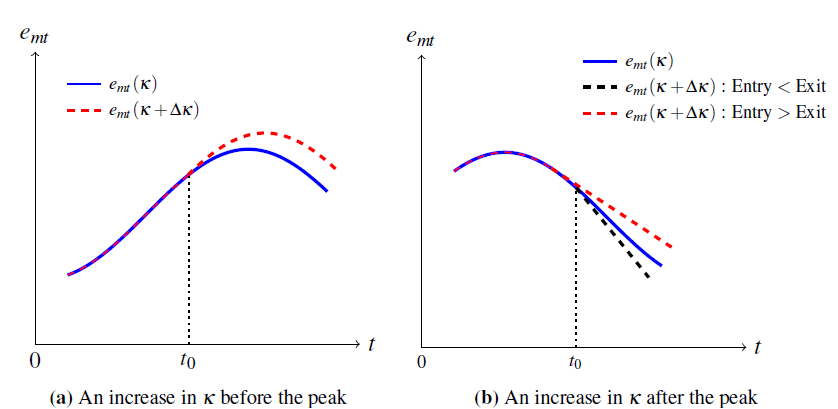

• Finance and Industrialization level

Figure III illustrates the impact of financial development level on the sectoral share of consumption expenditure in manufacturing. If an increase in financial development occurs before the peak of the manufacturing sector share curve, the impact is positive. This signifies that during the industrialization phase, enhanced financial development will support a higher inflow of resources into the manufacturing sector.

FIGURE III: Effect of an increase in financial development at time $t_0$ on manufacturing share

However, if this increase occurs after the peak, implying a deindustrialization phase, higher levels of financial development will instead spur the reallocation of resources from manufacturing to services. At the same time, it will also cause a more significant exit from the agricultural sector, thereby leading to a considerable influx into the manufacturing sector. The overall impact will thus depend on the levels of entry and exit in the manufacturing sector, which are determined by the differences in productivity growth rates across sectors.

III. The model to data

• Model fit

FIGURE IV: Data vs Model

Overall, the model effectively replicates the observed pattern of structural change in South Africa from 1960 to 2010, despite some deviations in the magnitude of changes in employment share across sectors

• Effect of an increase in financial development

FIGURE V: Impact of an incrase in the financial development on employement shares

Data from South Africa substantiates the theoretical model’s predictions. Increasing the financial development level decreases the agricultural employment share while the shares in the manufacturing and services sectors increase.

• Cross-country analysis

The cross-country analysis also shows that countries with a higher average level of financial development are those that have reached a higher peak in the manufacturing employment.

FIGURE VI: Financial development and peak manufacturing employement share across countries